RGC and the new ramp-and-dump schemes

The Equity Dispatch #44

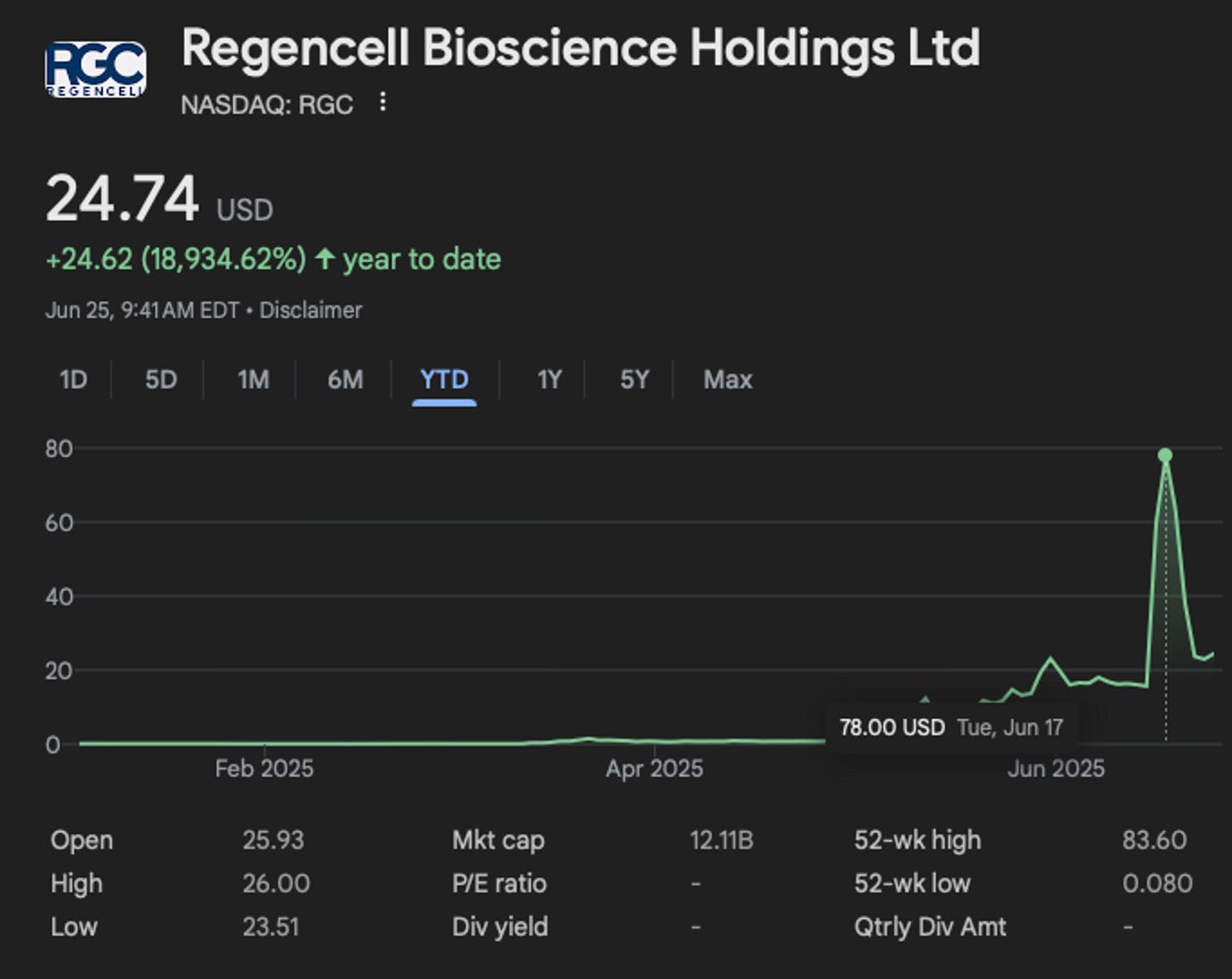

The absurd valuation the market has placed on Hong Kong-based biotech Regencell Holdings (NASDAQ: RGC), which claims to be devising Traditional Chinese Medicine (TCM) cures for ADHD, autism, and other neurocognitive disorders, has metastasized since our April 2 newsletter. RGC rose 12,980% (on a split-adjusted basis) from the time of our publication to the peak on June 17. The stock has fallen a good deal from its $78 value on June 17, but, at $22.95 as of this writing, there is still much more distance for RGC to fall.

And fall it will, we are certain. RGC has no commercial product and very little cash or revenue. The position of chief medical officer, seemingly important for a biotech company, remains vacant. We are skeptical that public investors are truly excited about a company that says it may use TCM remedies developed in an uncertain future to treat neurological disorders that have hitherto been intractable.

As a follow up to our examination of this dubious business, this week we looked at what appears to be an RGC stock pump and why, in this market, things like this keep happening.